tax preparation fee schedule 2019 pdf

Applicants were eligible for reimbursement payments only. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

Irs Free File Opens Jan 14 2022 Where S My Refund Tax News Information

LERGY TAX PROFESSIONALS Susan K.

. Therefore the composite return Form NJ-1080C uses the highest tax. 1The amount appropriated for property tax relief programs in the State Budget for FY 2019 affected income eligibility for 2017. 2019 BIRT SC Schedule.

SCHEDULE A Form 1040 or 1040-SR 2019 Rev. Individual Income Tax Return. Form 4506 - Request for Copy of Tax Return.

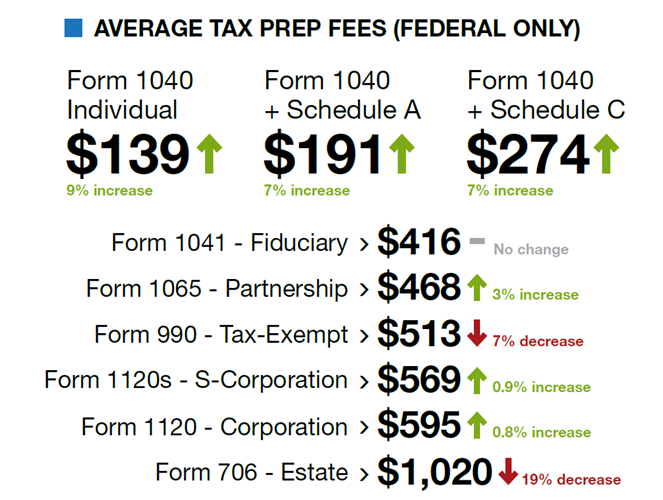

1040EZ Individual Income Tax Return 8300 1040A Individual Income Tax Return 9400 1040 Individual Income Tax Return 10500 104 State Income Tax Return 6500 State 1040 ES Estimated Tax for Individuals 2100 EA 1040X Amended Return for Individuals 7600 EA 1041 Fiduciary Income Tax Return 41900 MIN. Schedule A Itemized Deductions starting at 25. Schedule K-1 each 2500.

Non-Clergy Tax Preparation Fee Schedule Effective January 1 2019 Form 1040 includes W-2 but not other schedules 100 Forms and Schedules depending on complexity. Form 4506-T - Request for Transcript. Schedule B Interest and Dividends 25 per every 5.

Tax Return Fee Schedule. Tax preparation fee schedule 2019 pdf Sunday March 6 2022 Edit. Clergy Tax Preparation Fee Schedule Effective January 1 2019.

Federal Return up to 4 W-2s 125. 2019 Schedule 1 Form 1040 or 1040-SR Author. For new clients a 100 deposit is required in advance of tax preparation.

Forms 1040540 ES - Estimated Tax. 63 rows Rerun charge. State Return 80 per state.

Additional Income and Adjustments to Income Keywords. LERGY TAX PROFESSIONALS Susan K. Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes Income Statement Template 40.

Department of the Treasury Internal Revenue Service 99. Schedule F - Profit or Loss From Farming. January 2020 Itemized Deductions.

Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. A 100 deposit is requested in advance of tax.

Amended Returns fees for additional forms may apply 15000. Form 1040 ES Estimated Tax Vouchers. 150 Each 200 Each Schedule H -.

Schedule EIC - Earned Income Credit. Tax preparation fee schedule 2019 pdf Thursday September 15 2022 Edit. 2 - Supplemental Income and Loss.

Pdf Simple Tax Preparation Checklist Tax Prep Tax Prep Checklist Tax Preparation. Since a composite return is a combination of various individuals various rates cannot be assessed. Tax preparation fee schedule 2019 pdf Sunday March 6 2022 Edit.

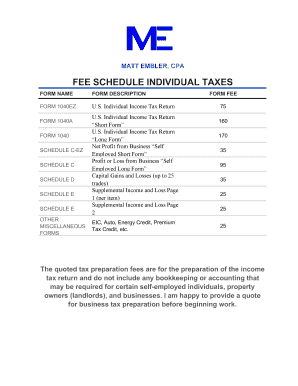

FORMSSCHEDULE DESCRIPTION FEE PER FORMS. Form 1040 page 1 and 2 not including state return 75.

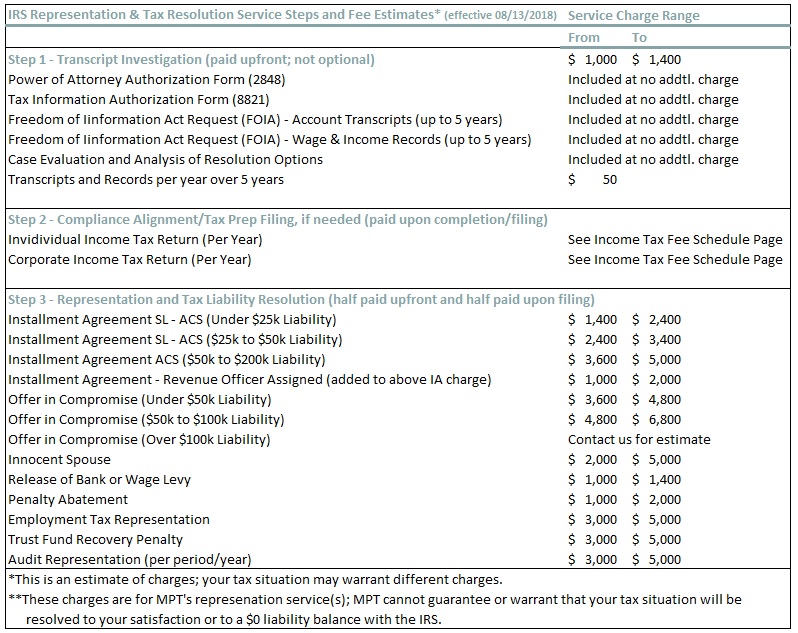

Representation Fees Master Plan Tax Solutions

Fillable Online Firm Fee Schedule Fax Email Print Pdffiller

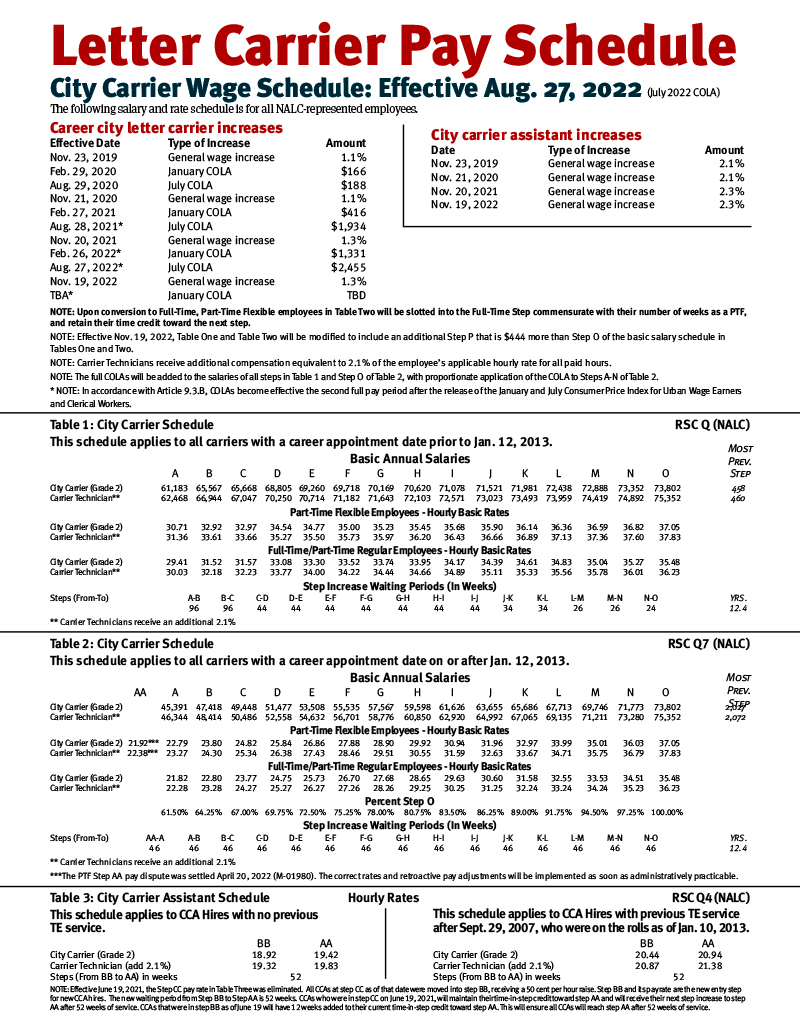

Pay Tables Cola Info Annuity Projections National Association Of Letter Carriers Afl Cio

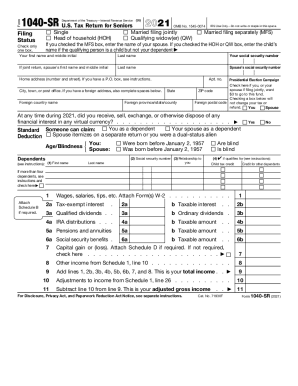

2019 Irs Form 1040 Sr Fill Out And Sign Printable Pdf Template Signnow

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

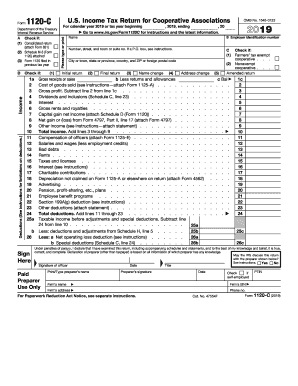

2019 1120c Form Fill Out And Sign Printable Pdf Template Signnow

Tax Preparation Fees How Much Does It Cost To Have Your Taxes Done

Schedule A Form 1040 Itemized Deductions Guide Nerdwallet

Federal Register Medicare Program Revisions To Payment Policies Under The Physician Fee Schedule And Other Revisions To Part B For Cy 2019 Medicare Shared Savings Program Requirements Quality Payment Program Medicaid

Tax Preparation Fees Ab Tax Accounting

This Additional Information Has Been Provided To Be Chegg Com

Free Tax Preparation Maplewood Library

2019 Catering Menu Evergreen Lodge

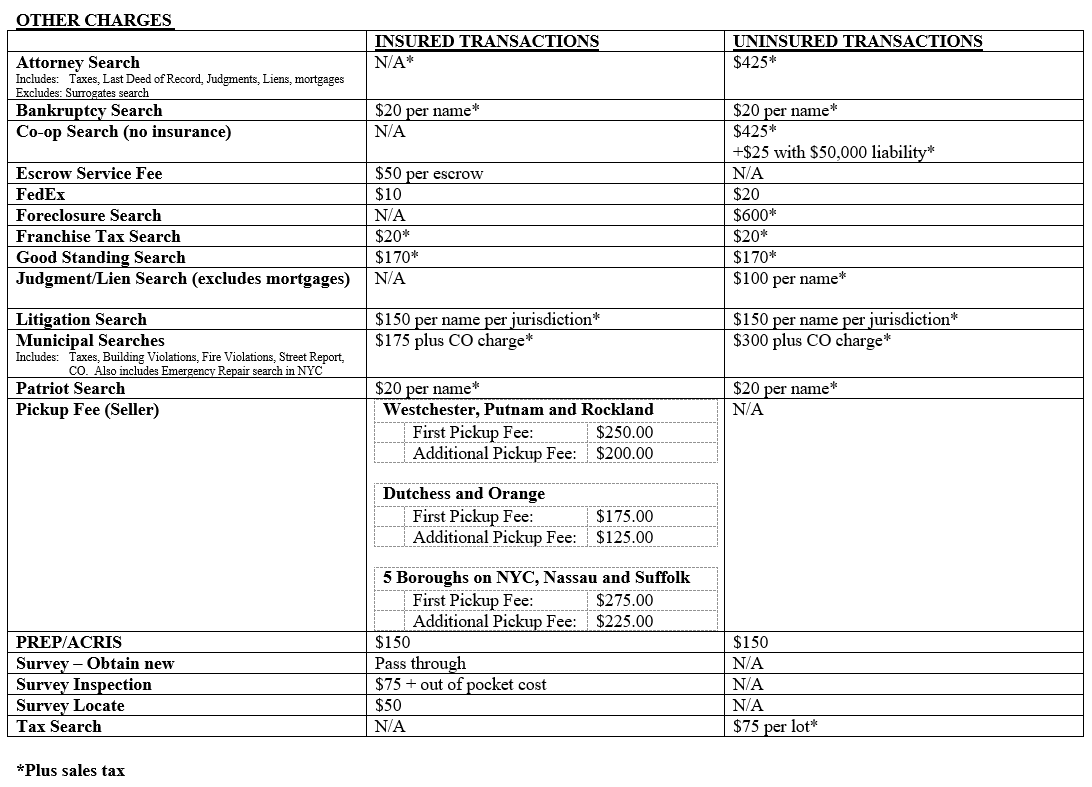

Fee Schedule Thoroughbred Title Services